SERVICES

SUBSCRIBE

Get our latest wealth managements insights right in your inbox.

OUR SERVICES

Portfolio Management Services

Oxford Harriman & Company provides institutional quality investment analysis and management for our clients.

We work with you to help determine your tolerance for risk, and to define a range of investment returns necessary to help you fund your objectives. We offer a large breadth of investment strategies, including both active, and passive strategies, utilizing individual equity positions, individual taxable and municipal bonds, mutual funds, and exchange traded funds (ETFs).

Investment Strategies Customized To Your Unique Financial Goals

Through our strategic planning process, we work with you to help develop an investment strategy that is consistent with your goals.

We provide customized asset allocation recommendations based on our understanding of your investment objectives and risk tolerance.

We work with you to help determine your tolerance for risk, and to define a range of investment returns necessary to help you fund your objectives.

We build each asset allocation strategy with your risk tolerance and return objectives in mind, combined with our current outlook for the financial markets and the global economic landscape.

We offer a large breadth of investment strategies, including both active, and passive strategies, utilizing individual equity positions, individual taxable and municipal bonds, mutual funds, and exchange traded funds (ETFs).

Our expertise in asset allocation includes:

- Defining risk tolerance and construction volatility strategies

- Efficient asset allocation using client-specific strategies

- Strong understanding & implementation of Modern Portfolio Theory

- Construction and utilization of forward-looking capital market assumptions

- Focus on volatility management, predictable costs, and tax efficiency

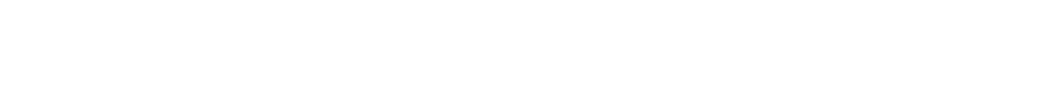

Our Envision® Process for Clarifying Your Goals

We conduct a personal interview with you to best understand your goals which are most important and gather other pertinent information necessary to complete your custom plan. If appropriate, we also consult with other professional advisors, including your legal and tax advisor, to understand all pertinent details of your financial circumstances.

IMPORTANT: The projections or other information generated by Envision regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Envision methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2005-2016 Wealthcare Capital Management LLC. All Rights

Oxford Harriman Portfolio Management

Assessment of your current portfolio

After working with you to identify your unique financial objectives, we conduct an assessment of your current portfolio.

Our portfolio assessment includes:

- Risk Analysis

- Volatility study

- Expected return

- Cost analysis

- Search for inefficiencies

We strive to create an efficient portfolio strategy for each client based on institutional-quality capital market assumptions. We use quantitative research using our forward looking capital market assumptions, combined with our understanding of past volatility, and the current economic environment, to help create portfolios that compensate our clients for the risk taken.

Our Portfolio Strategy

Our strategy for portfolio construction is based on a time-honored approach that works and includes our multi-step process.

With our process, we delve deep into not only your objectives, but into the math of portfolio construction to:

- Combine forward-looking assumptions with what has happened in the past.

- Build a volatility strategy for your portfolio that is stress-tested.

- Help to explain and manage the risks associated with the randomness inherent in the financial markets.

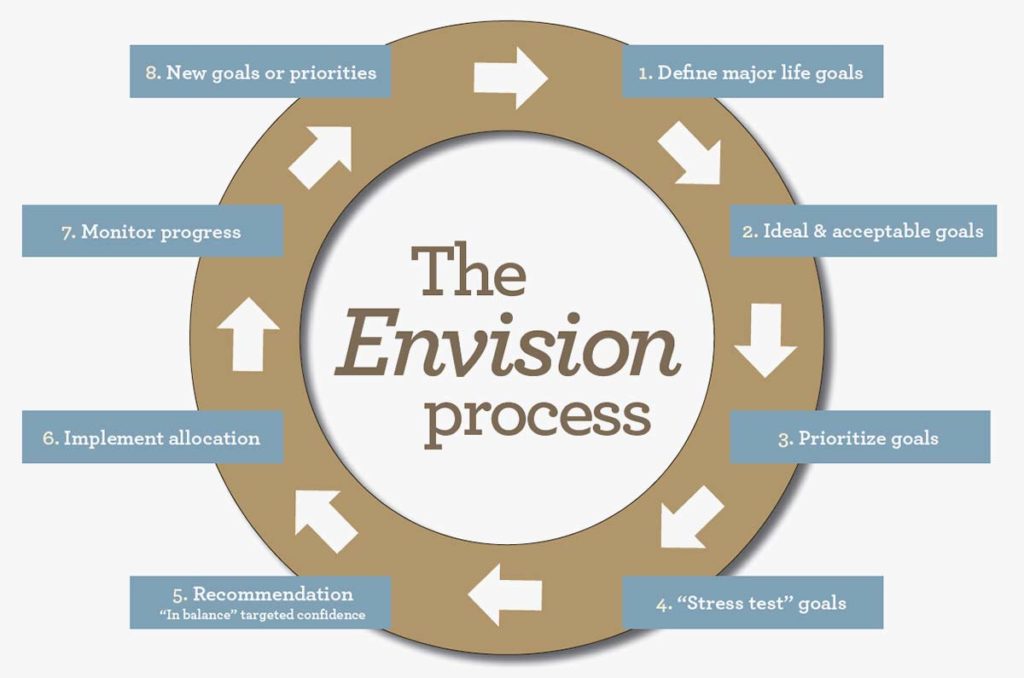

When combined with your portfolio, our Envision process makes it easy to keep track of your progress and realign your investment plan with your Target Zone whenever necessary.

Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2021 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.